HELPING SMALL BUSINESSES SUCCEED

Start Up blog

Latest blogs

Show blogs by topic:

The future of business plans: the benefits of using AI

Writing a business plan can be daunting and time consuming for novices and seasoned entrepreneurs alike. In this blog, we look at how AI is revolutionising the business planning process.

Date: 9 February 2024 By:

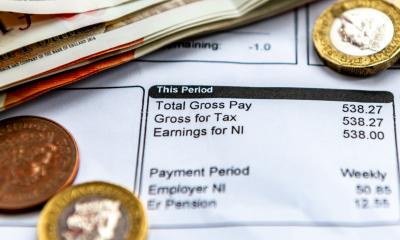

How will 2024 tax and NIC changes impact you?

The Chancellor announced some changes to National Insurance in his Autumn Statement. We look at what is changing in the realm of tax and National Insurance in 2024.

Date: 8 February 2024 By:

Organic growth: the entrepreneur's challenge

Organic growth relies on internal resources and capabilities rather than external acquisitions and investments. We explore the unique challenges of organic growth and how to overcome them.

Date: 30 January 2024 By:

Business Companion: a reliable voice in the misinformation age

In a world of fake news and misleading information, small businesses need reliable information that they can rely on. Backed by the government, Business Companion contains impartial free information.

Date: 29 January 2024 By:

B2B expert matchmaking for sole traders

Running a small business means wearing many hats. However, some tasks are better outsourced to an expert. Here's how a service platform can help you find the expert help your business needs.

Date: 18 January 2024 By:

Real-world problems that can be solved with a start up app

These days it seems there's an app for almost everything. We share some real-world examples of problems that can be solved with an app that might inspire the creation of your own small business app.

Date: 16 January 2024 By:

The best tips for using AI to plan your business

AI is becoming increasingly important to businesses and these days it can help you improve your business planning. We learn more in this blog.

Date: 16 January 2024 By:

Six common sole trader tax return mistakes

Sole trader self assessment tax return mistakes are not uncommon. We explore the six most common mistakes and explain how you can avoid them.

Date: 4 January 2024 By:

HMRC crackdown: how could it affect Airbnb hosts?

If you rent out property via Airbnb, HMRC may have you in their sights if you have not been paying tax on the income. Mike Parkes of GoSimpleTax explains more.

Date: 3 January 2024 By:

Does your side hustle need insurance in 2024?

The number of people running a UK side hustle is booming. However, running a side hustle without the proper protection could be costly. Markel Direct explains why you might need insurance.

Date: 3 January 2024 By:

A start up's guide to business formation

Limited company status affords you a degree of protection from your business' fortunes. Here's how to register your limited company.

Date: 13 December 2023 By:

Eight ways we can help you start a business in 2024

Eight things to do if you’re planning to start a business in 2024. Get free guides, listen to business podcasts and subscribe to the Donut newsletter.

Date: 13 December 2023 By:

2023 in review: Side hustles, influencers and AI

The best advice for small businesses published on the Donut websites in 2023, including articles, guides, news, blogs and podcasts.

Date: 13 December 2023 By:

How AI revolutionises everyday workplace interactions

AI is rapidly becoming an invaluable time and cost-saving resource for small businesses. We explore six ways it is transforming everyday workplace tasks.

Date: 12 December 2023 By:

Why inventory turnover matters (and how to manage it)

If you run a retail business, you will be holding stock. Your inventory turnover affects your profitability, so you need to manage it. Learn how in this article.

Date: 5 December 2023 By:

How AI can transform accounting for your start up

Neglecting business finances can be disastrous. It can limit growth opportunities and even lead to business failure. Discover how AI is transforming business accounting and finances.

Date: 21 November 2023 By:

How apps can help you comply with employment law

Employment law safeguards employee rights. Small businesses can't be expected to understand every rule. HR apps can help manage the admin and protect you from costly legal action.

Date: 21 November 2023 By: